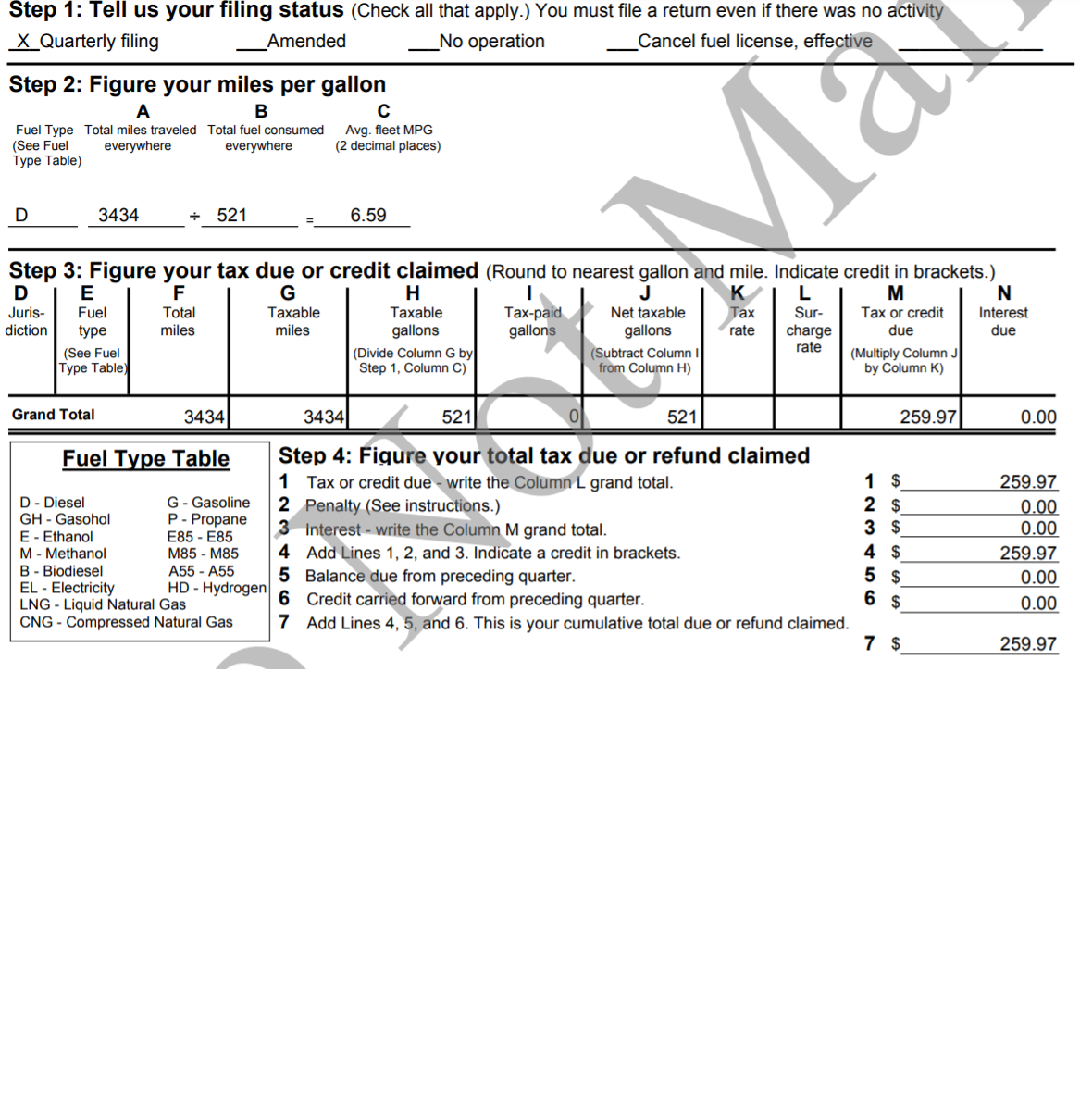

this is my first time doing ifta. I created a report from my ELD and punched in those miles/gallons into IL ifta reporting online. looks like I owe $259. that's it ?

IFTA report

Discussion in 'Questions From New Drivers' started by Chicago123456, Oct 2, 2021.

Page 1 of 2

-

-

Trucking Jobs in 30 seconds

Every month 400 people find a job with the help of TruckersReport.

-

My average is anywhere from $250-$350 every quarter that I have to pay

-

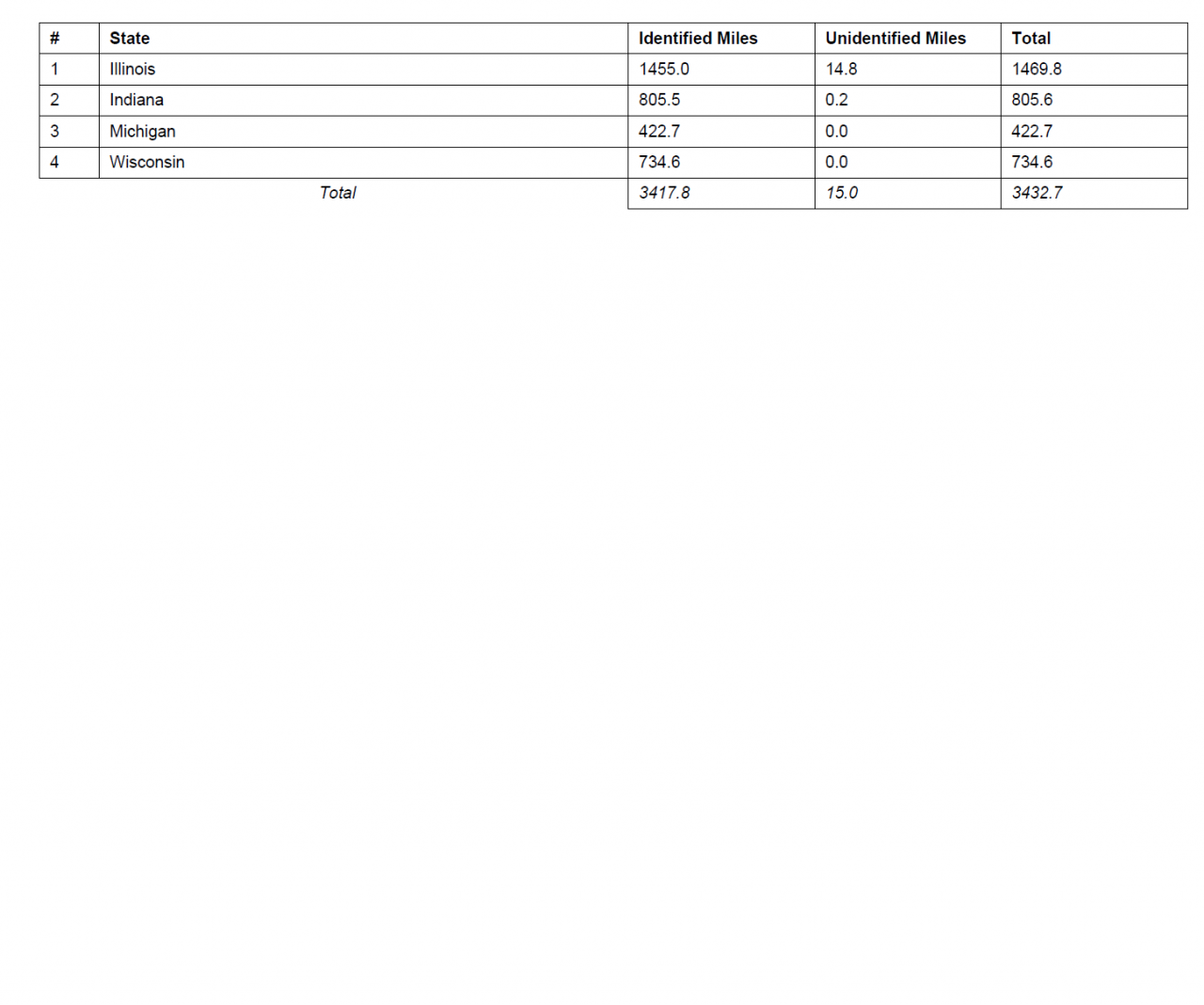

how many miles you drive every quarter ? ....and what's your breakdown per state ?

-

I drove 25,000 miles last quarter majority of those miles were in Arizona then California and last was Nevada.

I buy all my fuel in Arizona by my house, and that was a little over 2000 gallons.

I don’t know the breakdown per state, as I just dictate the miles to my wife who types them in on the form on the computer. -

If I remember, it was about 15,000 miles in Arizona, 5000 in California and the rest were in Nevada.

-

Something is wrong there. What states did you buy fuel in?

Each state has a different tax rate.

You will either get a credit from the states or charged depending on whether you bought too much or too little in relation to miles driven in that state. -

List all the states you traveled in with miles and fuel purchased in each state.

Based on your 6.59 mpg you posted I can probably figure it out for you when I get time. -

Yep. That’s probably it. That’s enough, if you have some extra money you’d like to get rid of. Let Me know. Lol. Seriously, I’ve never done them off an ELD. The only difference I see, are the “unidentified miles” My guess is they have an acceptable amount of miles for that designation. I’ve been off a couple miles from total and states total. That’s a bit different, but really the same thing. Been told they’re not worried about totals being off a few miles. That’s the only question I’d have. Call the IL. IFTA and ask. In Michigan they’re always more than happy to help. I’m sure other acceptable reporting software has totals that are a bit off, or unidentifiable.

-

I'm confused, the 500+ gal of fuel were 'tax paid' at the pump and should reduce the tax owed on the 3000+ miles at 6.Something MPG. move it to the tax paid column and you zero out.

We have on-site fueling by a vendor so ALL of my fuel is in NJ. ever quarter we have miles from MD to MA but 95% is NJ and 4.9% of the rest is mostly NY and PA.

After NJ hiked the tax rate and using the on line NJ MVC program my credits [ often lost in the manual days] have covered everything for the past 5 quarters and I still have credits to use.

So my IFTA is zero for over a year but NY HUT nails us around $250 - $300 a quarter and would be worse ecxept the two of the three 33,000# box trucks [always use unladen weight method for HUT] account for 3% of those NY miles so they reduce the HUT while the three of them do around 10 MPG and help my IFTA total MPG too.Last edited: Oct 3, 2021

-

Thank God, I looked at it and thought something was wrong. Thought I would've been the only one.

Trucking Jobs in 30 seconds

Every month 400 people find a job with the help of TruckersReport.

Page 1 of 2