Inflation Rises Slightly in December Amid Persistent Price Pressures

The U.S. economy saw a slight uptick in inflation during December 2024, according to the latest Personal Consumption Expenditures (PCE) Index report. The data, which serves as the Federal Reserve’s preferred measure of inflation, signals that price pressures remain sticky despite the Fed’s ongoing efforts to curb inflation through higher interest rates.

The rise in inflation, while modest, adds complexity to the Federal Reserve’s plans for interest rate adjustments in 2025. Although Fed officials had previously signaled the possibility of multiple rate cuts this year, persistent inflation may force them to reconsider or slow the pace of these cuts.

Key Takeaways from the Latest Inflation Report

- PCE Inflation Edges Higher: The headline PCE Index saw a slight increase, reflecting continued price pressures across multiple sectors.

- Core Inflation Remains Stubborn: The core PCE Index, which excludes volatile food and energy prices, also saw an increase, reinforcing concerns that inflation may not cool as quickly as anticipated.

- Consumer Spending Holds Strong: Despite higher borrowing costs, consumer spending remained resilient, contributing to steady economic growth.

- Interest Rate Cuts Remain Uncertain: With inflation still above the Fed’s 2% target, the central bank may delay or reduce the number of expected rate cuts in 2025.

The Federal Reserve’s Dilemma: Balancing Inflation and Growth

Federal Reserve Chair Jerome Powell has reiterated that the Fed will take a measured approach to interest rate adjustments, emphasizing that rate cuts will only come when inflation shows sustained improvement.

Currently, the Fed’s key interest rate stands at about 4.3%, down from a two-decade peak after three rate cuts at the end of 2024. Powell has indicated that the Fed will likely maintain rates at this level for the foreseeable future to ensure inflation continues to decline.

The central bank’s strategy hinges on higher borrowing costs reducing consumer and business spending, which in turn should slow inflation. However, recent strong consumer spending and economic growth suggest that demand is still robust, making the path to lower inflation more challenging.

Economic Growth and Inflation: A Mixed Picture

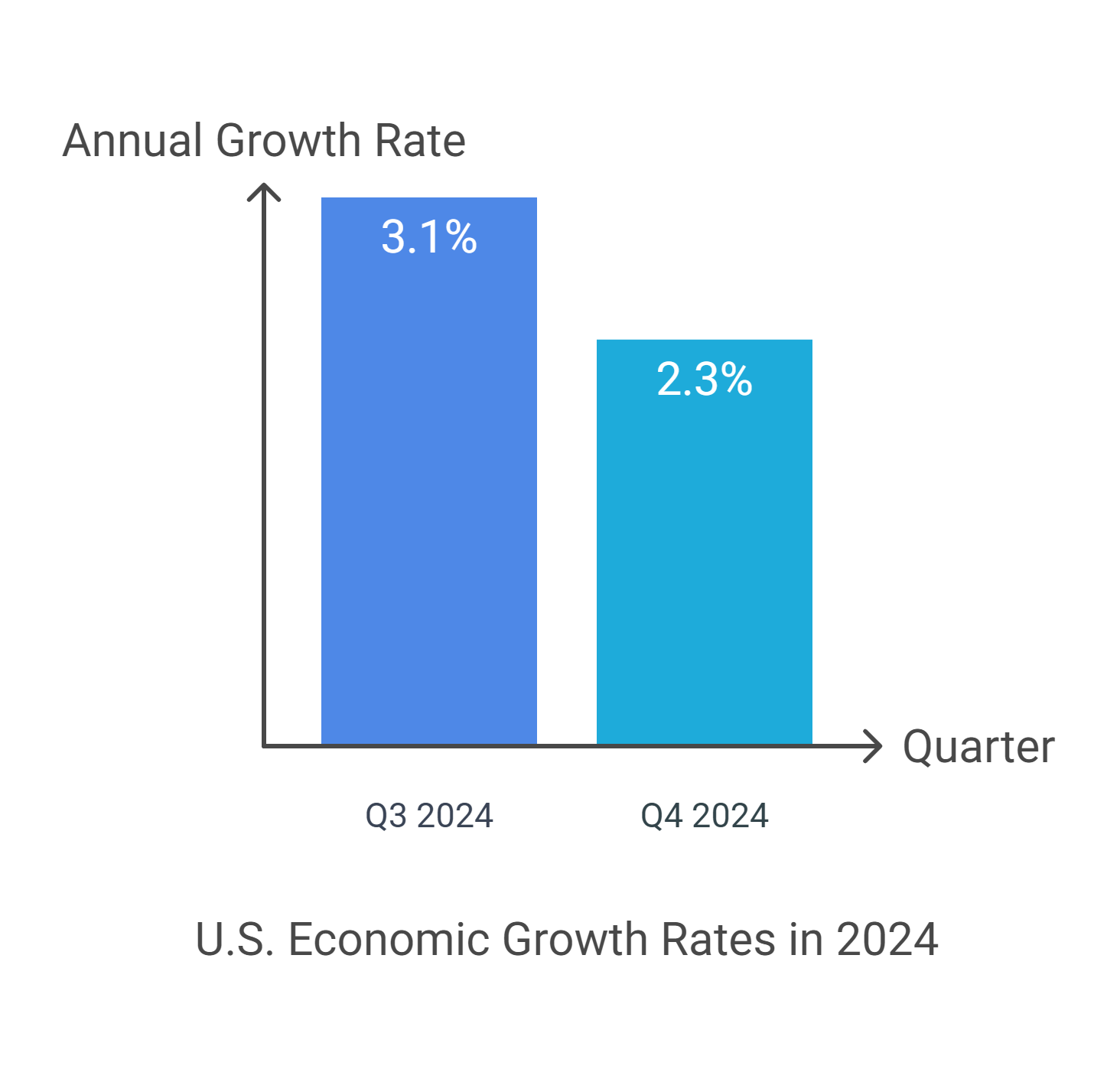

Despite inflationary concerns, the U.S. economy grew at a solid 2.3% annual rate in the fourth quarter of 2024. While this was a slight slowdown from the 3.1% growth seen in Q3, the data highlights the resilience of the U.S. economy.

A key reason for the slight deceleration in Q4 was a sharp reduction in business inventories, which economists believe could reverse in the coming months. As businesses rebuild their inventories, growth may pick up again in early 2025.

What’s Next for Inflation and Interest Rates?

While inflation is showing signs of persistent pressure, the broader economic picture remains uncertain.

- If inflation remains elevated, the Fed may delay rate cuts until later in the year or reduce the number of expected cuts.

- If inflation cools more quickly, the Fed could proceed with its expected rate reductions, helping to ease borrowing costs for businesses and consumers.

- Consumer spending and labor market strength will play a crucial role in determining how aggressively the Fed adjusts monetary policy in 2025.

As the economy navigates ongoing inflationary challenges, all eyes will remain on the Fed’s next moves, with financial markets, businesses, and consumers closely watching how policymakers respond to the latest data.

Source:

Leave a Comment